what is open closed-end credit

Open-end credit agreements are also sometimes referred to as revolving credit accounts. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as.

Closed End Credit By Colum Callahan

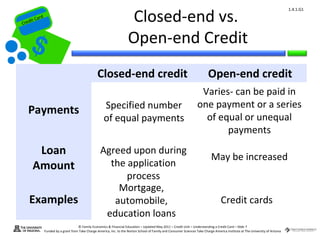

Closed-end and open-end credit differ depending on how funds are disbursed and how payments are made to the account.

. What are examples of open and closed ended. Open-end credit is a preapproved loan between a financial institution and borrower that may be used. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card.

Open end credit is also known as a revolving line of credit and is arranged as a pre-approved amount of credit with no set end date or expiration date. Open-end credit facilities are revolving financing options. You can make repeat purchases with an.

Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. On closed-end credit youll have a fixed. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment.

What is the difference between closed end credit and open end credit. Both of these credits charge interest. A borrower may repay.

With open-end credit youre only required to make a small minimum payment toward your outstanding balance each month. Open end credit is a pre-approved loan available from a financial institution. These loans come with lower credit approval amounts though.

A loan can be closed-end or open-end. This means that an open-line. What is the difference between open end credit.

The key difference between open-line of credit and closed-end credit is that open-line of credits are more flexible while closed-end credits are more restrictive. Open-end credit is a line of credit that can be borrowed again and again as long as payments are. Both may charge fees.

Close-end credit is a credit arrangement in which the borrower must repay the amount owned plus interest in a specific. Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product. Sometimes referred to as revolving credit lines credit cards and home equity lines of credit HELOC are open-end credit.

Closed end credit must be paid off by a specific set dat. Open end credit can be borrowed repeatedly. Credit asset classes corporate loans high yield bonds etc pay investors interest ie.

With closed-end credit you borrow money once and repay the loan. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. Closed-end credit is a type of credit that has a deadline for repayment.

Examples of closed-end loans. Open end credit helps the borrower to control the amount they borrow. Closed-end credit facilities offer higher loan amounts as often they.

In a closed-end credit the amount borrowed is. One example of open end credit is credit cards. Thats the core difference between these distinct forms of.

Click here to read my more of my analysis on CEFs. The main difference between open-credit and closed-end. Closed-end credit is a one-time installment loan you usually take out for a specific purpose.

What is the difference between closed end credit and open end credit.

Mlo Mentor Section 32 Coverage Tests Firsttuesday Journal

Open End Credit Vs Closed End Credit Lantern By Sofi

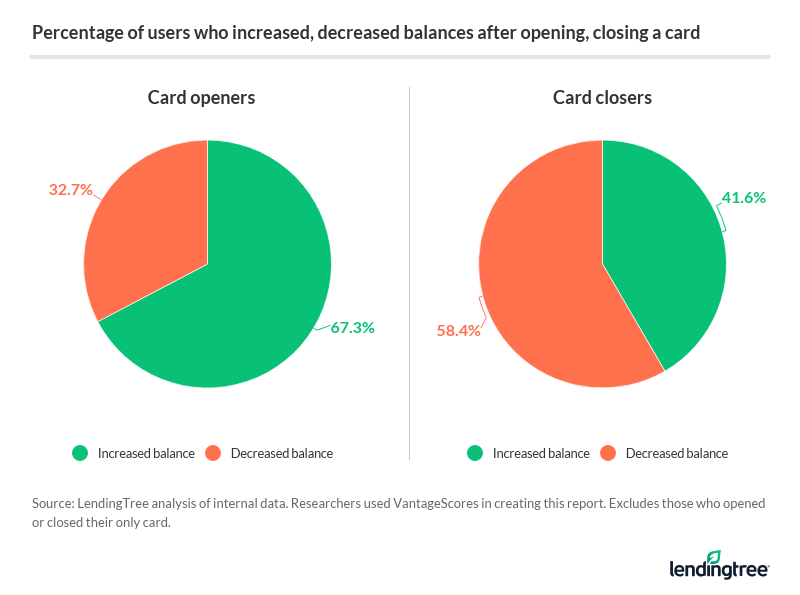

Credit Score Movements When Opening Closing A Card Lendingtree

What You Need To Know About Lines Of Credit Extra Blog

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

:max_bytes(150000):strip_icc()/GettyImages-707452833-5ae73fce43a1030036ceb1d6.jpg)

How Closed End Credit Is Paid Off

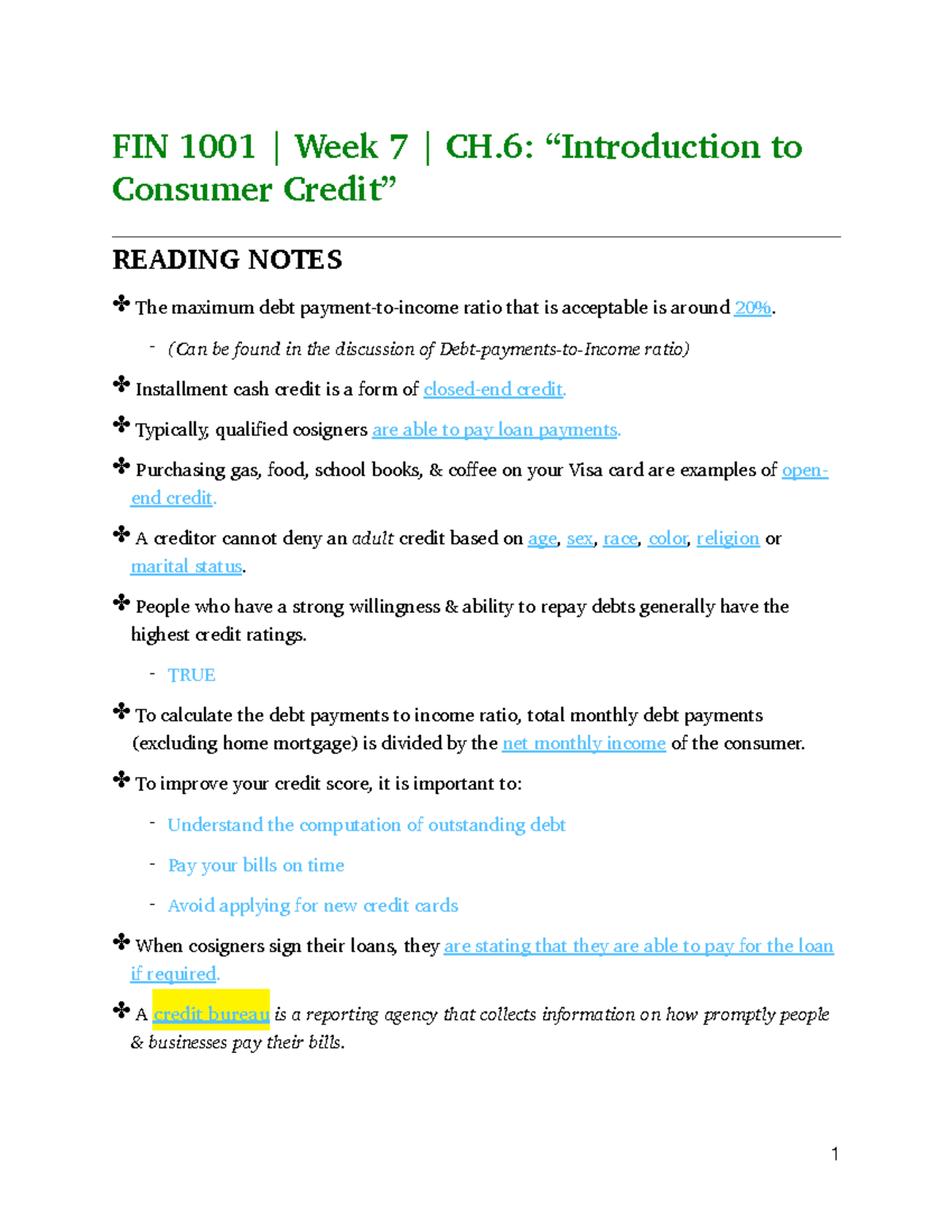

Fin 1001 Week 7 Ch 6 Notes Fin 101 Csusb Studocu

Intro To Home Loan Closing Costs Mortgage Closing Costs Box Home Loans

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Comply Partial Exemption Processing

Difference Between Open End Credit And Closed End Credit

Ffiec Releases 2021 Mortgage Lending Data 2022 06 28 Cuna News

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Federal Register Home Mortgage Disclosure Regulation C Temporary Increase In Institutional And Transactional Coverage Thresholds For Open End Lines Of Credit

Similar To Financial Algebra Quarter 1 Project Crossword Wordmint